| Why did IRDAI restrict the advertisement of ULIPs as “Investment Product”? On June 19, 2024, the Insurance Regulatory and Development Authority of India (IRDAI), which oversees the insurance sector in India, issued a circular prohibiting insurance companies from promoting ULIPs (Unit Linked Insurance Plans) as investment products. |

Circular issued by IRDAI

ULIPs – Investment or Insurance ?

A ULIP is a life insurance policy that combines risk coverage with investment opportunities. The performance of ULIPs is directly influenced by fluctuations in the capital market.

Let’s compare ULIPs to mutual funds to see how fees affect returns

Mr. Ram and Mr. Mukesh each invest ₹1,00,000 annually, with Ram opting for a ULIP (ICICI Pru Signature) and Mukesh choosing a mutual fund (ICICI Prudential Bluechip Fund Direct-Growth). Both expect a 10% annual return, but the actual returns of Mr. Ram differ because of ULIP charges.

Returns Comparison: ULIP vs Mutual Fund

Scenario 1: After 5 Years (2014-2019)

By 2019, both Mr. Ram and Mr. Mukesh have invested a total of ₹5,00,000 (₹1,00,000 annually for 5 years).

- Mr. Mukesh’s Mutual Fund (ICICI Prudential Bluechip Fund Direct-Growth): Assuming a 10% return with no upfront charges, his investment grows to approximately ₹6.30 lakhs.

- Mr. Ram’s ULIP (ICICI Pru Signature): Although the expected return is 10%, various charges reduce Mr. Ram’s actual return to about 7% annually. Thus, his ₹5,00,000 investment grows to only ₹5.11 lakhs.

Scenario 2: Policy Maturity After 10 Years (2014-2024)

By 2024, both complete 10 years of investments, each contributing ₹10,00,000.

- Mr. Mukesh’s Mutual Fund: At a 10% return rate, Mukesh’s investment swells to approximately ₹15.94 lakhs.

- Mr. Ram’s ULIP: Due to charges, Ram’s ULIP delivers a lower effective return of 7%. His total investment grows to only ₹10.97 lakhs.

Scenario 3: Death of Policyholder (2014-2024)

In the event of Mr. Ram’s death during the investment period, his nominee would receive the highest of the following:

- The sum assured (₹10 lakhs)

- 105% of total premiums paid up to that point (₹10.5 lakhs)

- The current fund value (₹10.97 lakhs)

For Mr. Mukesh’s mutual fund, there’s no guaranteed payout; the value of his investments would be settled based on the market value at the time of his death.

Why the Difference in Returns?

In ULIPs, significant portions of investments go towards upfront fees, administration charges, and mortality charges. For Mr. Ram, ₹12,000 per year (12% of the premium) is deducted, meaning only ₹88,000 is invested, reducing his effective returns to 7%.

Disclaimer: This is a hypothetical comparison for illustration purposes. Actual returns, charges, and benefits will vary based on specific plans and market conditions.

Charges and conditions associated with ULIPs:

| Charge Type | Description | Charge Range |

| Fund Management Charge (FMC) | ULIPs have a FMC which is used to cover costs like research and fund administration and this is capped by IRDAI at 1.35% per annum on the funds invested. | 0.5% – 1.35% per annum |

| Mortality Charge | The mortality charge covers the cost of providing the policyholder’s death benefit. It varies based on factors like age, coverage amount, and health condition. | Rs 2000- Rs 10,000 per annum |

| Premium Discontinuance Charges | It is a charge levied on the policyholder when he cancels the policy. | Rs 5,000- Rs 15,000 |

| Policy Administration Charge | This charge may be levied monthly or annually and is typically applied throughout the entire policy term. | Rs 300 – Rs 1,000 per month |

| Partial Withdrawal Charges | It is charged when the policyholder withdraws money in between after the minimum lock-in period, but before the end of the ULIP plan. | Rs 1,000 – Rs 3,000 per withdrawal |

Note: The charges associated with ULIPs vary from plan to plan. To find the charges for a specific ULIP plan, please refer to the website of that plan.

Other Conditions

| Minimum Lock-in Period | A ULIP plan has a mandatory lock-in period of 5 years, during which withdrawals are not allowed. |

Mr.Ram understood that various charges were deducted from his premiums and only the remaining got into the fund in which he invested, leading to a significant drop in his returns.

Reason why IRDAI Barred Advertising ULIPs as “Investment Products”

| The primary reason is to prevent the mis-selling of ULIPs by insurance companies, who often market them as investment products with added insurance benefits, which is misleading. Insurance companies were marketing ULIPs by comparing them to mutual funds, without clearly informing customers about the additional charges within ULIPs that reduce their overall returns. A key point to note is that the returns shown by insurance companies for ULIPs are returns based only on the invested portion of the premium and not the entire premium. |

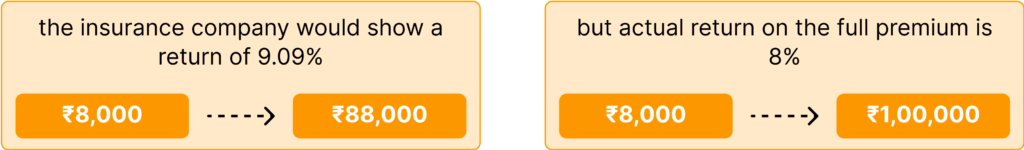

For example, if Mr. Ram pays a premium of ₹1 lakh and ₹12,000 is deducted for charges, the returns are calculated on the remaining ₹88,000.

| ₹1 lakh | – | ₹12,000 | + | ₹88,000 |

This makes the published returns seem higher than the policyholder’s actual total return.

If a return of ₹8,000 is earned in the first year

In summary, ULIPs offer a unique blend of insurance and investment, providing a different value proposition from mutual funds and traditional insurance.

Investors should carefully assess their financial goals against the benefits of ULIPs before making a choice.

SUMMARY

Refer the image below for the summary of the entire Read. Hope you became smarter with money now.