THE UNCONVENTIONAL

Tax Strategy

by CHANDRALEKHA

CMA, Ex-KPMG

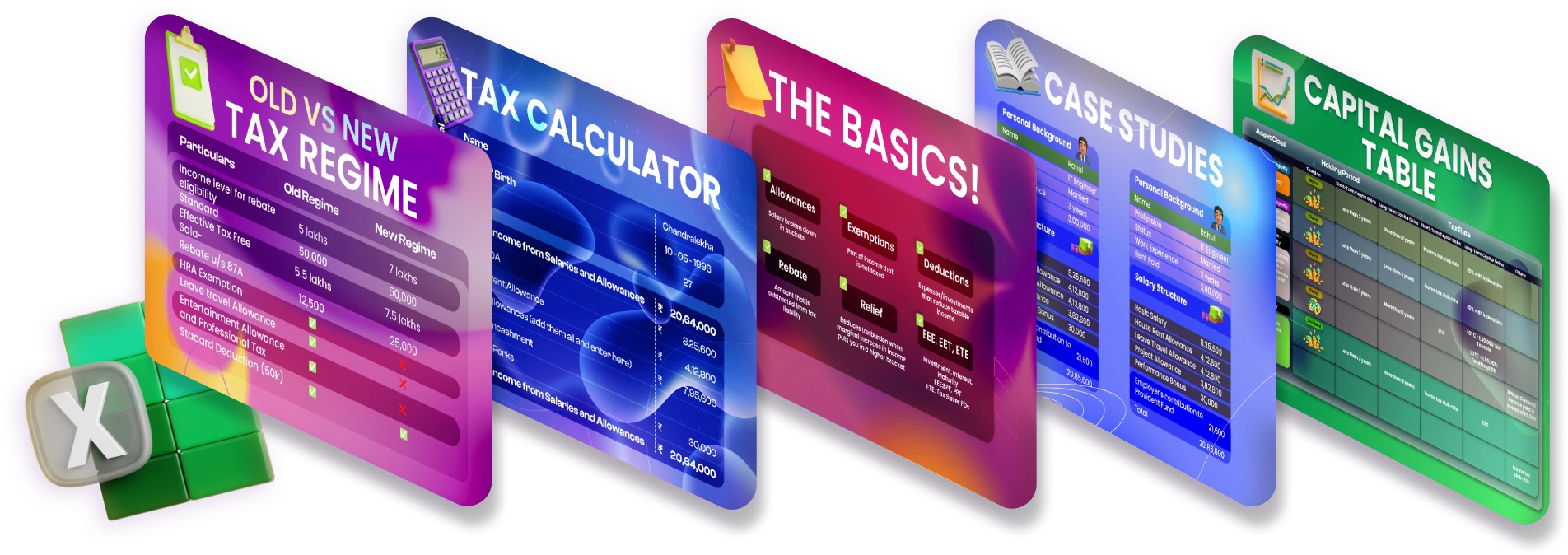

Case

Studies

Advance Tax

Calculator

3hrs+ Recorded

Masterclass

Bonus

Handouts

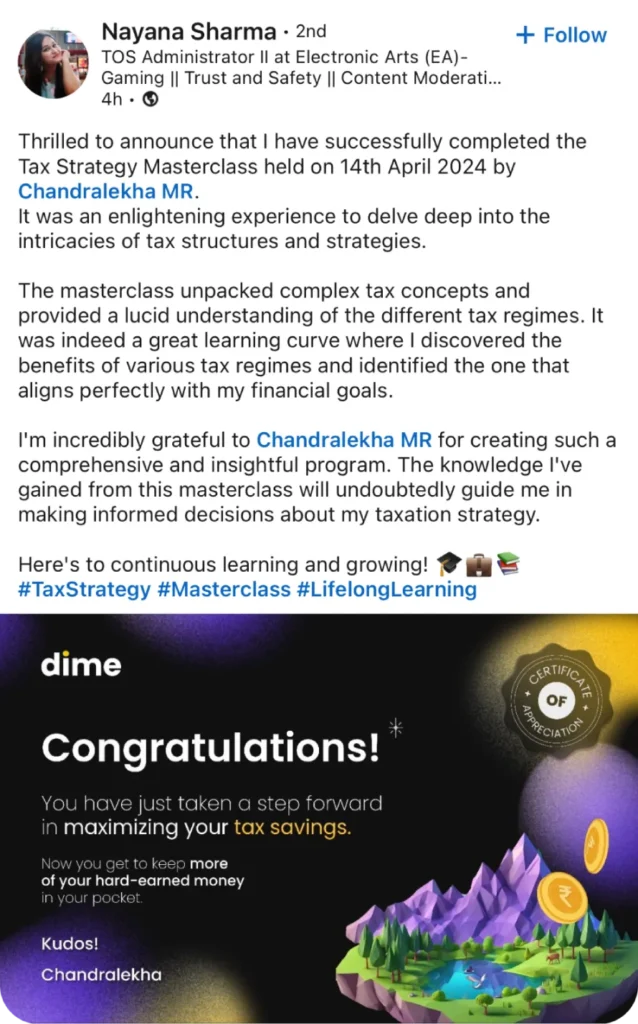

Certificate of

Completion

What will you learn?

in 3hrs+

Tax 101

We master the basics first! Exemptions, Deductions, Allowances, CTC vs in-hand salary, TDS, Income Tax Heads, Advance tax and more.

Salary

Restructuring

Learn advanced tax-saving hacks to restructure various components of your salary on your payroll portal to optimise tax savings.

Tax

strategies

Enough of basics! We dive deep to learn advanced tax-saving strategies with Capital Gains, Investment hacks, deductible allowances, Gift Tax and more.

Right Tax

regime

Choosing the right Income tax regime can save a lot in taxes. You will learn the difference between the old and new tax regime in a structured way and be able to decide what suits you the best.

Income Tax

Calculator

Learn how to use our powerful in-house built Advance Income Tax Calculator crafted by experts to help you decide which tax regime is best for you.

It doesn’t stop here...

we have more!

Case Studies!

This is not a regular Masterclass. We will explore 4 case studies in our course to understand tax strategies at a deeper level.

Here is a Bonus!

You get access to bonus Tax handouts that will help in making your financial life simpler and saving you crazy number of hours.

100

+

people already love it

rating

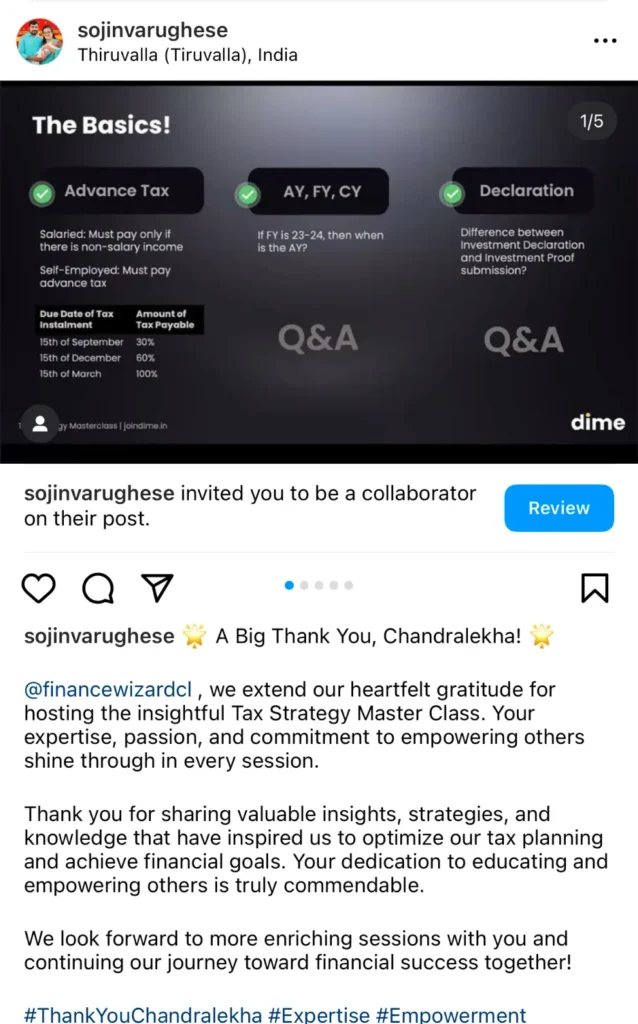

Stories & Reviews

that speak

Ishan Saraf

It was absolutely fantastic. The presentations were so catchy, clear and memorable. Easily the best 499 Rs I spent this financial year.

Pranali Meh

Class was very insightful. Loved how you explained in detail be it salary structure and changes that we can make or tax saving strategies. Also the case studies helped in understanding it correctly.Ty.

Rohit Reeves

The session was excellent. Resolved most of my doubts and provided broad insights in Tax Deductions and savings. Thanks Chandralekha for the “MASTER”class –

K. Renuka

It was really informative and actually tho I am a student and about to start my first job this is must and thank for that.

Shreya Gurav

A very very useful session by Chadralekha… And so worth it… The amount of efforts she has put into making it is amazing… I’m glad I attended the session

Prasad Dokhale

It was as very useful session for me inorder to plan my upcoming financial plans. The way you are explaining the things and providing the solution of each question is fabulous

Is this you...?

then, this course is for you!

Salaried

Hurt to see huge chunk of salary go in taxes? Learn to reduce your tax burden and save more for your financial goals.

Freelancers

Freelancing brings fluctuating earnings. We will teach you how to optimise your taxes with strategies tailored for this.

Students

In Tax 101, we talk about everything basic! This will provide you with a head start for your financial journey.

First

& highest ever

1000

+

downloaded our

Tax Calculator

As soon as the New Income Tax regime was introduced in the Budget 2023, within 7 days we were the first ones to launch a crazy Old vs New Income Tax regime Calculator with a webinar on how to make a decision using it. Guess what? it was massive hit!

Meet your Mentor

- Expert in Finance

Chandralekha

Founder of Dime

A Certified Management Accountant (CMA) and Certified Internal Auditor (CIA), Chandralekha is a seasoned finance expert and a passionate Educator on a mission of “Helping India Decode Money”. Her prior experience as a consultant at KPMG underscores her deep-rooted expertise in Finance.

What sets Chandralekha apart is not just her academic and professional credentials but her ability to break complex financial concepts and tax strategies.

She has been trusted by over 8 lakh followers and garnered 10 crore+ views on Taxation content alone, which signifies her expertise in decoding taxation concepts crisply and practically.

In this course, Chandralekha has encapsulated her in-depth knowledge, experience, and knack for simplification to guide you to become a master at managing taxes.

950k+

Followers

15k+

Followers

Featured in

Not a normal Masterclass!

We believe in a practical approach. There is no point of you going out of the webinar with knowledge you already knew!

So we go beyond.

Frequently Asked Questions

After you sign up for the course, the access link and all the course materials will be sent to your registered email.

We’ve filled all the gaps in the market and expertly curated the most comprehensive Tax calculator that isn’t publicly available. The reviews speak! The best part is we don’t just give you the calculator but also walk you through it to unlock its full potential.

Who doesn’t want to save taxes? Choosing the right regime for you is an essential step towards it. The new tax regime has lower tax rates but with fewer tax deductions and

the old one has higher tax rates with more deductions. It is important to find your custom answer to it based on a solid plan you will make after attending the Masterclass.

We’ve got the most practical case studies where we will discuss applying tax strategies and restructuring one’s salary based on the need to optimize tax.

No, you get lifetime access to the course! Isn’t that awesome?

We start with the basics and then level up. So if you are a beginner, you should definitely join and make sure you get the most out of it.

Yes absolutely! You will receive a certificate of appreciation for completing the Tax Strategy Masterclass.

The masterclass is non-refundable. We strive to provide a quality experience and ensure you get the utmost value for your money.

Tax Masterclass Course

2000+ people already enrolled!

₹499

₹999

Coupon Code: Use DIME100 at checkout

Enjoying Dime?

Share the fun, and let’s all grow together!

Contact us

- dimecrew@joindime.in

Legal

Pages

Copyright © 2025 Dime Digest