What are Long-Term Capital Gains?

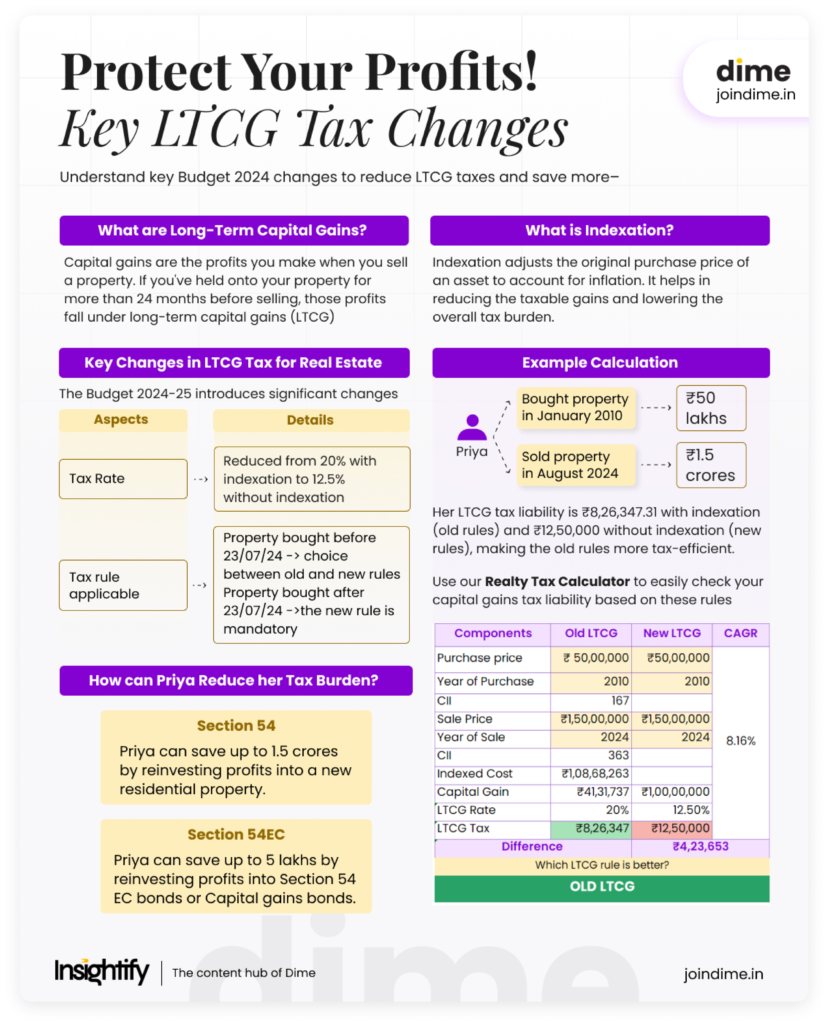

Capital gains are the profits you make when you sell a property. If you’ve held onto your property for more than 24 months before selling, those profits fall under long-term capital gains (LTCG).

Key Change in LTCG Taxation for Real Estate in Union Budget 2024

| Purchase Date | Rule Applied |

| Before July 23, 2024 | Choose between the old or new tax rule |

| On or After July 23, 2024 | New tax rule automatically applied |

What is Indexation, and Why Is It Important?

Indexation is the process of adjusting the purchase price of an asset to account for inflation, ensuring that the real value of the asset is maintained over time. By applying indexation, the taxable gains on an asset are reduced, which can significantly lower the tax liability for long-term holdings. Understanding indexation is crucial for accurate tax planning and calculating the tax owed on long-term gains.

Calculating LTCG on Real Estate Sale

Let’s consider a practical example to illustrate the LTCG calculation based on the new rules

Priya, a 45-year-old professional, bought a property in January 2010 for ₹50 lakhs and sold it in August 2024 for ₹1.5 crores. Since Priya held the property for more than 24 months, it qualifies as a long-term capital asset, and the gains from the sale are subject to LTCG tax.

With the help of our Realty Tax Calculator, you can easily check your own capital gains tax liability.

Comparing Old and New Tax Rules

- Old Rules (20% with Indexation): Her tax liability would be ₹8,26,347.31.

- New Rules (12.5% without Indexation): Her tax liability would be ₹12,50,000.

In this case, the old LTCG rules result in a slightly lower tax liability for Priya, making them the better choice.

Break Even

Break Even point is a point where the LTCG liability is same under both the regimes. For example, if Priya would have sold her property for ₹20,702,035, the tax under both the rules would have been same.

What is Section 54 and how can it help Priya save taxes?

Section 54 of the Income Tax Act provides tax exemption on long-term capital gains from the sale of a residential property if the gains are reinvested in another residential property within a specified period. This benefit helps taxpayers reduce their tax liability when upgrading or purchasing a new home.

Eligibility and Reinvestment Requirements

| Aspects | Details |

| Sale Details | Priya sold her property in August 2024 for ₹1.5 crores. |

| Section 54 Exemption | Save on LTCG tax by reinvesting profits from the sale into a new residential property. (Up to 1 Crores) |

| Reinvestment Options | 1) Buy a new property within 1 year before selling the old one. 2) Buy a new property within 2 years after selling the old one. 3) Construct a new house within 3 years after selling the old one. |

By reinvesting the entire ₹50 lakh profit from the sale into a new residential property, Priya would have no LTCG tax liability. Note that if only a portion of the profit is reinvested, tax would be due on the remaining amount.

What is Section 54EC and how can it help Priya save taxes?

Section 54EC of the Income Tax Act allows the reinvestment of capital gains from the sale of property into specified bonds, providing an additional way to save on LTCG tax.

Eligibility and Investment Requirements:

| Aspects | Details |

| Sale Details | Priya sold her property in August 2024 for ₹1.5 crores. |

| Section 54EC Exemption | Save on LTCG tax by reinvesting profits from the sale into Section 54 EC bonds or Capital gains bonds such as National Highway Authority of India (NHAI bonds), or Power Finance Corporation Limited(PFC) bonds, within 6 months of sale. (Up to 5 lakhs) |

| Reinvestment Options | 1) Buy a new property within 1 year before selling the old one. 2) Buy a new property within 2 years after selling the old one. 3) Construct a new house within 3 years after selling the old one. |

By investing ₹5 lakhs in these bonds, Priya can avoid paying LTCG tax on the amount invested.

Combining Section 54 and Section 54EC

Priya could diversify her tax-saving strategy by using Section 54 to invest in a new house and Section 54EC to invest in bonds, optimising her tax benefits.

Conclusion

Priya can minimise her LTCG tax burden by combining property reinvestment under Section 54 and bond investments under Section 54EC, ensuring smarter tax savings and maximising her profits.

Summary

Refer the image below for the summary of the entire Read. Hope you became smarter with money now.

FAQs

What happens if I sell a commercial property instead of a residential property?

LTCG from commercial property is taxable under similar rules, but Section 54 benefits are only available for reinvestment into residential properties. Consider Section 54EC bonds for exemptions.

Does the new LTCG rule apply to inherited properties?

Yes, inherited properties qualify for LTCG taxation, with the holding period including the duration the property was held by the original owner.

Can I use multiple properties to claim Section 54 exemptions?

No, the exemption under Section 54 can only be claimed for one new residential property. Exceptions apply under specific circumstances, like court rulings.

Are there any limits on the reinvestment amount under Section 54?

For most cases, reinvestment in a residential property up to the capital gains amount is tax-exempt, but the total gains exceeding ₹10 crores may face additional restrictions.

Can non-resident Indians (NRIs) benefit from these LTCG exemptions?

Yes, NRIs are eligible for Sections 54 and 54EC exemptions, provided they comply with reinvestment and bond purchase timelines.

Are there any tax implications if I reinvest but later sell the new property?

If the reinvested property is sold within three years, the LTCG exemption is reversed, and the previously exempted amount is added back to your taxable income.

What if the property sale involves joint ownership?

In joint ownership, the LTCG tax liability and exemption benefits are divided proportionally based on ownership share.