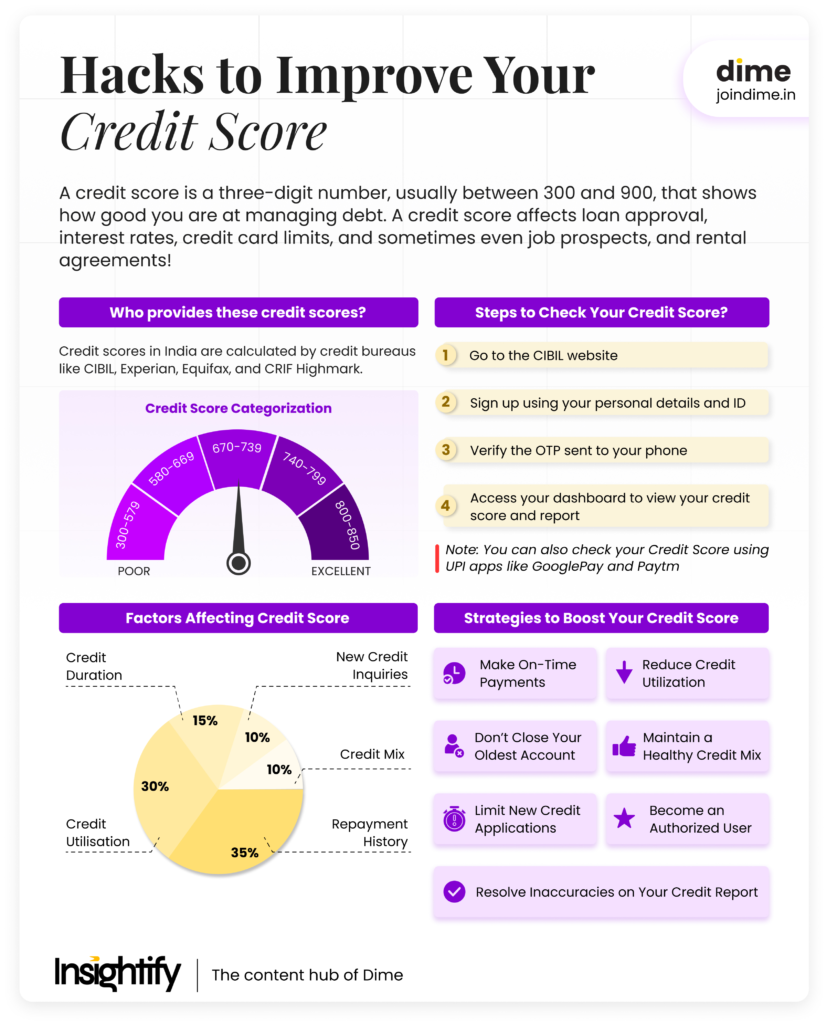

Discover credit score, key factors behind it, and easy ways to improve it for a better financial future.

A credit score is a three-digit number, usually between 300 and 900, that shows how good you are at managing debt. A credit score affects loan approval, interest rates, credit card limits, and sometimes even job prospects and rental agreements!

How to Check Your Credit Score?

You can check your credit score through platforms like CIBIL, Experian, Equifax, and CRIF Highmark. Many banks and financial apps such as GooglePay, PhonePe, and Paytm also offer free credit score checks. You just need to provide your PAN card number and basic personal details to generate the score.

| Steps to check credit score using CIBIL |

| 1. Steps to check credit score using CIBIL | 2. Sign up using your personal details and ID |

| 3. Verify the OTP sent to your phone | 4. Access your dashboard to view your credit score and reportSign up using your personal details and ID |

Who Determines Your Credit Score and What does it imply?

Credit scores in India are calculated by credit bureaus like CIBIL, Experian, Equifax, and CRIF Highmark.

These agencies collect data from banks and financial institutions on your borrowing history, payments, and credit usage. Your score reflects your creditworthiness. Higher scores make it easier to access loans at better interest rates, while lower scores indicate higher risk to lenders.

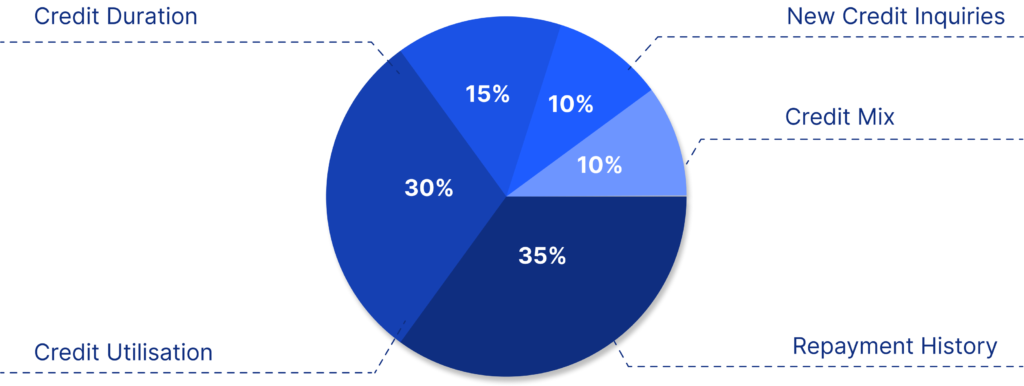

Key Factors Impacting Credit Score

- Payment History: Lenders check if you’ve paid bills on time; late payments damage your score significantly.

- Credit Utilization: Using a high percentage of your available credit (over 30%) signals potential financial strain to lenders.

- Credit Duration: A longer history of responsible credit use demonstrates stability, improving your credit score.

- Credit Mix: Managing different types of credit, like loans and credit cards, shows responsible borrowing behavior.

- New Credit Inquiries: Too many new applications within a short period reduce your score, indicating high credit reliance.

Strategies to Improve your Credit Score

Improving your credit score isn’t rocket science. It just takes some planning and good financial habits. So, let’s break down actionable strategies to improve

1. Make On-Time Payments

Credit impact:

Since payment history makes up 35% of your credit score, consistent on-time payments significantly boost it.

Actionable tips:

• Set up autopay for your credit card bills and EMIs to ensure you never miss a payment.

• Register for services that give you credit for other payments too, like rent, utilities, and mobile bills.

How fast it works:

You may start seeing an improvement as soon as you consistently make on-time payments

2. Reduce your Credit Utilization

Credit impact:

The amount of credit you’re using versus your total credit limit, known as credit utilization, accounts for 30% of your credit score. Experts recommend keeping your utilization under 30%, but lower is always better.

Actionable tips:

• Pay down credit card balances as soon as possible.

• You can use more credit but pay down the balance before your billing cycle closes to reduce the impact of high utilization.

• If your utilization rate is still high, ask your credit card provider to increase your credit limit, but only if you can control your spending!

How fast it works:

Once credit card companies report a lower balance to credit bureaus, your score could improve within a few months.

3. Don’t Close your Oldest Account

Credit impact:

The length of your credit history makes up 15% of your credit score. Closing your oldest credit card can shorten this history and negatively impact your score.

Actionable tips:

• Keep your oldest credit card open, even if you rarely use it.

• Set up small recurring charges like utility bills to keep the card active.

How fast it works:

Credit history is built over time, but closing an old account could hurt your score quickly. Keep those old accounts open for the long haul.

4. Maintain a Healthy Credit Mix

Credit impact:

Having a variety of credit types—like credit cards, home loans, and auto loans—can positively impact 10% of your credit score. This shows lenders you can handle different types of credit responsibly.

Actionable tips:

• Don’t open new lines of credit just for the sake of it, but aim for a balance between secured (home loans) and unsecured credit (credit cards).

• If you’re just starting out, consider applying for a credit-builder loan or a secured credit card.

How fast it works:

Building a credit mix takes time, so no rush here. Focus on adding credit gradually as your financial needs evolve.

5. Limit New Credit Applications

Credit impact:

Each time you apply for new credit, a hard inquiry is made on your credit report, which could temporarily lower your score. This accounts for 10% of your total score, and too many applications in a short period can be a red flag for lenders.

Actionable tips:

• Only apply for new credit when you truly need it.

• Check if lenders offer prequalification options, which don’t impact your credit score.

• If you’re shopping around for loans, try to do it within a 14-45 day window to minimize the impact on your score.

How fast it works:

Hard inquiries remain on your credit report for two years but only affect your score for one year.

6. Resolve Inaccuracies on your Report

Credit impact:

Mistakes on your credit report—like incorrect late payments or fraudulent activity—can significantly lower your score. Disputing these inaccuracies can quickly improve your credit.

Actionable tips:

• Regularly check your credit report through services like CIBIL.

• If you find any errors, immediately dispute them with the credit bureau.

How fast it works:

Credit bureaus usually resolve disputes within 30 days, so you could see improvements within a month if the error is corrected.

7. Become an Authorized User

Credit impact:

If you’re new to credit or looking to rebuild, being added as an authorized user on someone else’s credit card can help you benefit from their positive payment history.

Actionable tips:

• Ask a family member or close friend with a good credit history to add you as an authorized user on their card.

• Ensure the card issuer reports to credit bureaus for the maximum impact.

How fast it works:

You could start seeing benefits within a couple of months, depending on how often the card issuer reports to the credit bureaus.

Conclusion

Building a solid credit score takes time, but with these strategies in place, you’ll be well on your way to improving your credit score. Just be patient, stay disciplined, and watch your credit score climb.

Remember, it’s never too late to start building good financial habits!

SUMMARY

Refer the image below for the summary of the entire Read. Hope you became smarter with money now.

FAQs

Will checking my own credit score lower it?

No, self-checks are considered soft inquiries and don’t affect your credit score. Regularly reviewing your credit report helps monitor your financial health.

What is considered a good credit score in India?

A credit score above 700 is generally considered good, with 750 and above being excellent. Higher scores enhance your chances of loan approvals and favorable interest rates.

How long do late payments remain on my credit report?

Late payments can stay on your credit report for up to seven years, potentially lowering your credit score during that period.

Does my income level influence my credit score?

No, income isn’t factored into your credit score. The score reflects credit management, not earnings.

Do closed accounts affect my credit score?

Closing accounts can reduce your available credit and shorten credit history, potentially lowering your score. It’s often better to keep old accounts open.

How does identity theft impact my credit score?

Fraudulent activities can lead to unauthorized debts, harming your credit score. Regular monitoring and prompt reporting of suspicious activity are crucial.