Discover how a disciplined SIP strategy can help you reach your ₹1 crore goal while navigating market fluctuations with help of rupee cost averaging.

What’s SIP, Anyway?

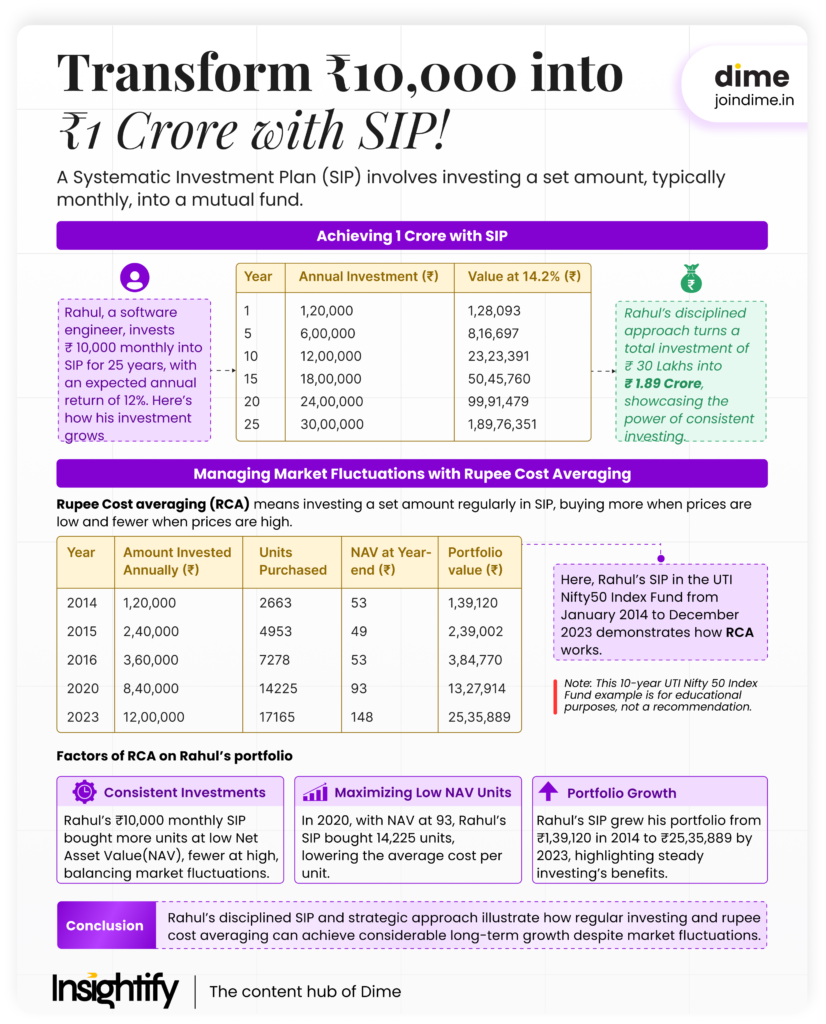

A Systematic Investment Plan (SIP) is a strategy where you regularly invest a set amount, usually monthly, into a mutual fund. A fund manager handles the fund, making investment decisions based on market trends. This consistent approach helps you build wealth steadily over time.

How to Reach ₹1 crore by doing SIP ?

Let’s take the example of Rahul, a software engineer, who is set to reach ₹1 crore in the next 25 years.

Now, Rahul’s Investment Plan

| Monthly Investment | Time Horizon |

| ₹ 10,000 | 25 Years |

| Expected Annual Return |

| 12% (based on historical data) |

The Growth of Rahul’s Investment Over Time

| Year | Amount Invested Annually (₹) | Value at 12% (₹) |

| 1 | 1,20,000 | 1,28,093 |

| 5 | 6,00,000 | 8,16,697 |

| 10 | 12,00,000 | 23,23,391 |

| 15 | 18,00,000 | 50,45,760 |

| 20 | 24,00,000 | 99,91,479 |

| 25 | 30,00,000 | 1,89,76,351 |

Rahul’s commitment to investing ₹10,000 each month has truly paid off, demonstrating the powerful impact of consistent investments over time. After 25 years, his total investment of ₹30,00,000 has grown to an impressive ₹1,89,76,351.

While this example of Rahul’s investment journey shows the power of consistency, understanding the market more practically will help him plan his SIP journey more effectively.

Handling Market Fluctuations with Rupee Cost Averaging

Rupee cost averaging, a key advantage of SIPs, is like putting your investments on autopilot by investing a fixed amount regularly. This automated approach adapts to market fluctuations, buying more units when the NAV (Net Asset Value) is low and fewer units when it’s high, which helps average out your investment costs over time.

To illustrate this, let’s analyze Rahul’s SIP journey with a real mutual fund:

UTI Nifty 50 Index fund – Direct Growth.

Now, Rahul’s Investment Plan

| Monthly Investment | Time Period |

| ₹ 10,000 | January 2014 to December 2023 |

| Investment Period | Fund |

| 10 Year | UTI Nifty 50 Index Fund – Direct Growth |

Chart Analysis : UTI Nifty 50 Index Fund (2014-2023)

(This illustration focuses on a 10 year period to provide a more practical and current example)

Source: Value Research

Chart Analysis

UTI Nifty 50 Index Fund (2014-2023)

The chart shows a steady rise with some ups and downs, especially in 2016 and 2020. Despite these dips, consistent investing took advantage of lower NAVs, leading to significant growth after the recovery. This shows the benefits of rupee cost averaging in smoothing out market fluctuations.

The table below highlights how rupee cost averaging helped Rahul reduce risk during market dips, ensuring he continued to accumulate wealth even in volatile markets

| Year | Amount Invested Annually (₹) | Units Purchased | NAV at Year-end (₹) | Portfolio value (₹) |

| 2014 | 1,20,000 | 2663 | 53 | 1,39,120 |

| 2015 | 2,40,000 | 4953 | 49 | 2,39,002 |

| 2016 | 3,60,000 | 7278 | 53 | 3,84,770 |

| 2017 | 3,84,770 | 9245 | 69 | 6,35,964 |

| 2018 | 6,00,000 | 10967 | 81 | 7,73,728 |

| 2019 | 7,20,000 | 12562 | 91 | 10,16,859 |

| 2020 | 8,40,000 | 14225 | 93 | 13,27,914 |

| 2021 | 9,60,000 | 15354 | 123 | 18,84,432 |

| 2022 | 10,80,000 | 16312 | 133 | 21,75,275 |

| 2023 | 12,00,000 | 17165 | 148 | 25,35,889 |

Factors of RCA on Rahul’s portfolio

Consistent Investments Despite Market Changes: Rahul committed to investing ₹10,000 every month through his SIP, regardless of market conditions. For example, in 2015, when the NAV was lower at 49, his SIP bought 4,954 units—2,290 more units than the previous year. However, in 2021, when the NAV was higher, his SIP bought fewer units (15,354), adding only 1,110 units compared to the previous year.

Maximizing Units When NAV Is Low: In 2020, despite the market downturn due to the pandemic, Rahul’s SIP purchased the highest number of units (14,225) because the NAV dropped to 93. This illustrates how SIPs capitalize on market dips, as the fund manager’s strategy of buying more units at lower prices effectively reduces the average cost per unit.

Portfolio Growth Over Time: Despite market fluctuations, Rahul’s consistent investments led to significant portfolio growth. His portfolio, which was valued at ₹1,39,120 in 2014, grew to ₹25,35,889 by 2023. This highlights how rupee cost averaging through regular investments can help build wealth over time by smoothing out market volatility.

(Disclaimer: The values in the table are for illustrative purposes only. This example uses the UTI Nifty 50 Index Fund purely for educational purposes and does not constitute a recommendation of the fund.)

A disciplined SIP strategy with rupee cost averaging is a great way to build wealth steadily. By investing a fixed amount regularly, regardless of market conditions, you can see steady growth. Rahul’s investment in the UTI Nifty 50 Index Fund and similar examples show how sticking with a SIP leads to impressive results, proving that consistent investing is a smart way to reach your financial goals.

SUMMARY

Refer the image below for the summary of the entire Read. Hope you became smarter with money now.

FAQs

How does an SIP differ from a lump-sum investment?

An SIP allows you to invest a fixed amount regularly, spreading out your investments over time, while a lump-sum investment is a one-time commitment. This difference can impact returns, especially during market volatility.

Can I increase my SIP contributions over time?

Yes, most SIPs offer the flexibility to increase your contributions. This option can help you reach your financial goals faster, especially as your income grows.

Is it possible to pause or stop an SIP if needed?

Many fund houses allow you to pause or stop your SIP temporarily. This flexibility can help manage finances if you face unexpected expenses.

How do I choose the right mutual fund for my SIP to ensure steady growth?

Choosing a fund involves considering factors like past performance, fund type, risk level, and expense ratio. Index funds, for example, offer market-linked returns and typically lower fees, but consulting a financial advisor can also help align the choice with your goals.

What if I want to switch to another mutual fund mid-investment? Will I lose my accumulated units?

You can switch funds, but there may be exit load fees or tax implications if switched too soon. All units accrued remain yours, but be mindful of potential costs involved.