| What is SWP? An SWP, or Systematic Withdrawal Plan, allows you to withdraw a set amount of money from your mutual fund at regular intervals, like monthly or quarterly, by automatically selling some of your unit |

How does SWP work?

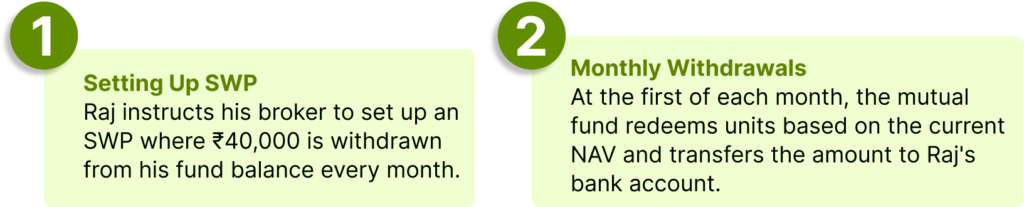

| 1. Set your SWP | 2. Withdrawal Amount |

| Once you’ve invested enough in mutual funds, you can set up a Systematic Withdrawal Plan (SWP) with your broker to get regular payouts | You decide how much and how often to withdraw—monthly, quarterly, etc. The fund automatically sells the required units to match your withdrawal. |

| 3. Units redeemed | 4. Steady income |

| The number of units sold depends on the fund’s NAV. Higher NAV means fewer units are sold; lower NAV means more units. | The withdrawal amount is credited to your bank account, giving you a reliable income. |

| 4. Investment grows |

| The remaining units stay invested and keep growing based on the market. |

Let’s understand this with the help of an example:

Meet Raj, who has been diligently investing in a mutual fund that offers SWP over the last 30 years of his career.

Now that Raj is retiring, he wants to ensure a steady stream of income instead of withdrawing his savings all at once.

He decided to set up a Systematic Withdrawal Plan (SWP) after retirement for 30 years to help manage his finances during retirement.

Here’s how Raj sets up his SWP

| Total Investment | Withdrawal Amount | Investment Period |

| 80,00,000 | ₹40,000 per month | 30 years |

SWP Calculator

Process

Benefits for Raj

- Regular Income: Raj receives ₹40,000 every month, which supplements his pension, helping him cover daily expenses without financial worry.

- Investment Growth: Since Raj isn’t withdrawing all his money, the remaining investment keeps growing, helping him earn more profits over time.

By setting up an SWP, Raj can enjoy financial stability without worrying about market fluctuations or outliving his savings.

Taxation of SWP

When you redeem your mutual fund holdings via SWP, you may earn capital gains on redemption. Those capital gains are taxed based on the type of mutual fund redeemed and its period of holding.

| Type | Short-term capital gains tax < 1 year | Long-term capital gains tax ≥ 1 year |

| Equity mutual funds | 20% | 12.5% without indexation |

| Debt mutual funds | Slab rate | Slab rate |

Wait, there’s more!

Here are 4 few ways SWP can help you apart from securing your retirement

| 1. Supplementing Income |

| If you’re planning to start a new venture, take a career break, or to switch jobs, your income may not be predictable. Setting up an SWP from your mutual fund investments can give you a steady monthly cash flow to meet your needs. |

| 2. Funding Higher Education |

| If you’ve got kids heading to college, an SWP can be a lifesaver. Instead of paying tuition fees in big chunks, you can invest money monthly and use an SWP to manage these expenses semester by semester. |

| 3. Managing Emergency Funds |

| During times like the pandemic, when financial instability is common, setting up an SWP can provide regular income from your emergency savings or investments to cover daily expenses. |

| 4. Systematic Reinvestment |

| As you approach a big financial goal, like buying a house or funding a large project, you might want to start securing your profits. An SWP can help you gradually shift money from Investments to EMIs. |

SWP could be a smart way to secure your: retirement, steady income, and investment growth without the need for constant management.

SUMMARY

Refer the image below for the summary of the entire Read. Hope you became smarter with money now.

FAQs

What happens if the NAV drops significantly during my SWP?

If the NAV drops, more units will be redeemed to meet your withdrawal amount, which could reduce your investment faster. It’s essential to monitor the fund’s performance periodically.

Can I start an SWP with any mutual fund?

Yes, SWPs can be set up with most mutual funds, including equity, debt, and hybrid funds. However, the tax implications and risks vary with the fund type.

What is the “SWP interest rate”?

The “SWP interest rate” refers to the returns generated by the mutual fund on your investment. It depends on the fund’s performance and is not a fixed rate. For example, equity mutual funds may provide higher returns but come with higher risk.

Can I modify or stop my SWP?

Yes, you can modify or stop your SWP at any time by contacting your fund house or broker. The flexibility ensures you can adjust withdrawals based on your needs.