Let’s look at the things that one should do and shouldn’t do using the example of Mr.Aditya who is a Marketing Specialist at WOW Media Ltd. in Bangalore.

Mr.Aditya’s salary details

| Components | Amount (Rs) |

| Basic Salary | 5,00,000 |

| HRA | 2,50,000 |

| LTA | 20,000 |

| Other Allowances | 2,00,000 |

| Bonus | 1,00,000 |

| Medical Insurance | 50,000 |

| Gross Salary | 11,20,000 |

| Less : Deduction | |

| Employee’s contribution to provident Fund | 60,000 |

| Professional Tax | 2,400 |

| CTC Gross Salary Deductions | 10,57,600 |

Note : Mr.Aditya doesn’t have any taxable capital gains

Now let’s look at what Mr.Aditya and you should do to file the ITR properly and beneficially

1) Choosing the Right Form

There are 4 ITR forms

| ITR-1 | Income up to INR 50 lakh from salary, pension, one house property, and other sources (like interest). |

| ITR-2 | Income from salary/pension, multiple house properties, capital gains, other sources (like interest), and foreign assets income. |

| ITR-3 | Those having income from a business or profession. |

| ITR-4 | Those with income from a business or profession under the presumptive taxation scheme. |

- Mr.Aditya should choose ITR-1, as his annual salary is less than Rs.50 lakhs and he doesn’t have any taxable capital gains.

- Filing using the wrong form can render the return invalid.

2) Claim your deduction and exemptions

- An exemption refers to specific types of income that are not taxed, while a deduction is an amount subtracted from your income to lower the taxable portion.

- The new tax regime does not allow any deductions or exemptions. However, the old regime offers various deductions and exemptions for taxpayers, including a standard deduction of Rs. 50,000.

For example, if Mr. Aditya is eligible for the following deductions, he can claim them according to the tax regime he opts for :

| Components | Old tax regime | New tax regime |

| HRA | 2,50,000 | N/A |

| Standard deduction | 50,000 | 50,000 |

| Professional tax | 2,400 | 2,400 |

| 80C deduction (ELSS) | 1,50,000 | N/A |

| 80CCD(2) employer’s NPS contribution | 50,000 | 50,000 |

| 80D Medical Insurance | 50,000 | N/A |

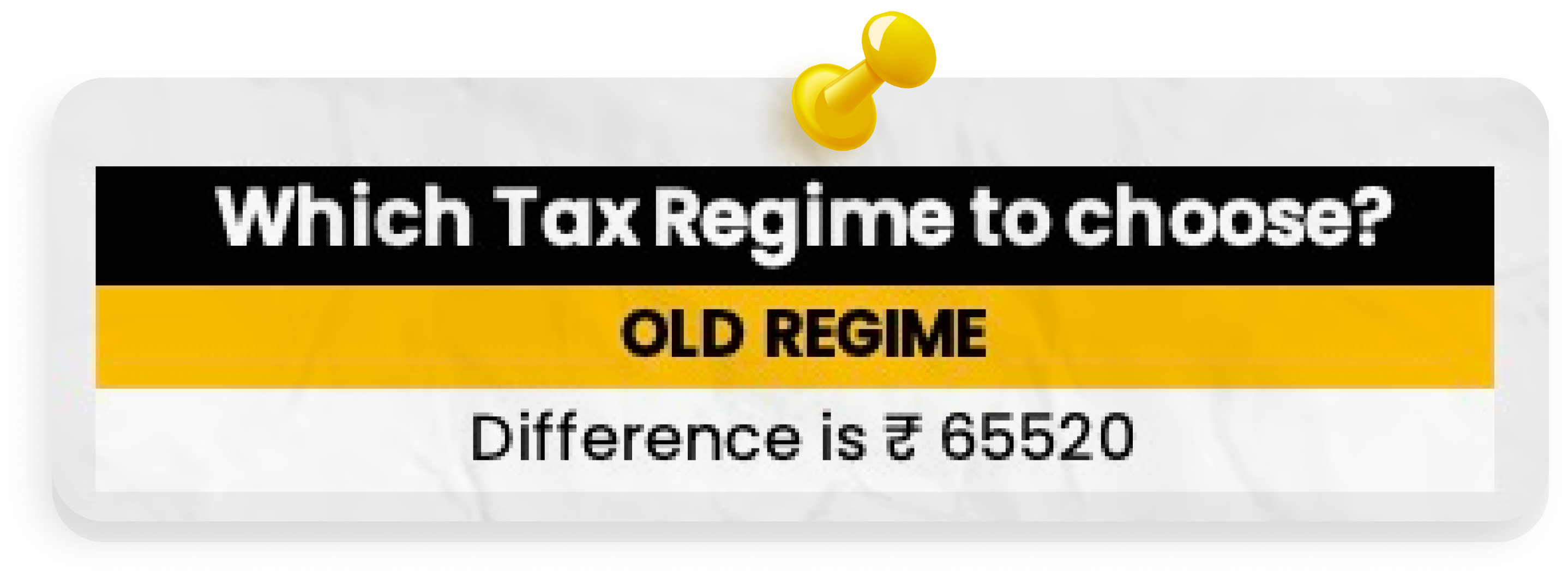

3) Choosing the correct Tax regime

- Individuals with business or professional income can change their tax regime only once.

- Salaried individuals like Mr.Aditya can switch between the old and new tax regimes each year during filing.

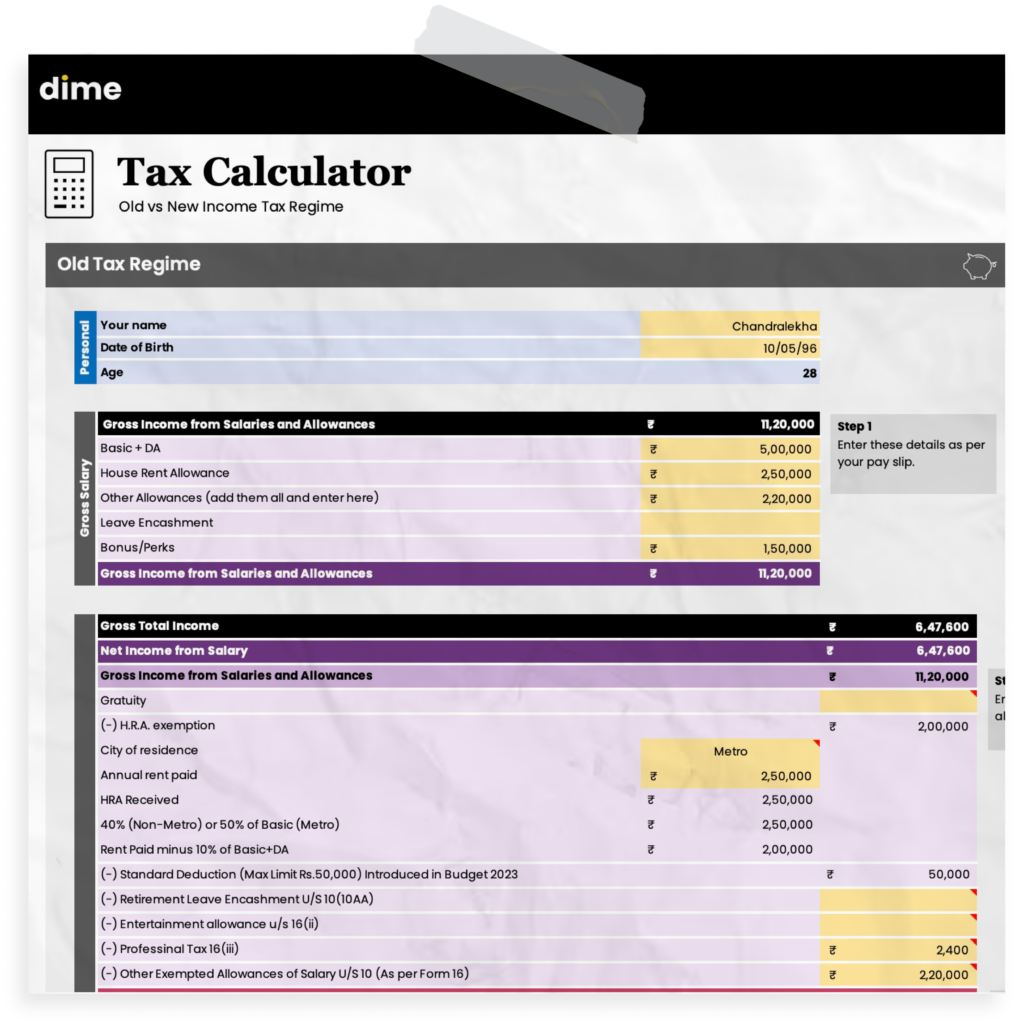

- So Mr. Aditya has used our Advance Tax calculator to help him choose between a new tax regime and old tax regime. Following table reflects the information he got with the help of calculator

| Components | New Regime (Rs) | Old Regime (Rs) |

| Salary Income | 11,20,000 | 11,20,000 |

| Less exemptions : | ||

| HRA | N/A | 2,50,000 |

| Other allowances | N/A | 2,20,000 |

| Less deductions | ||

| 80C(ELSS) | N/A | 1,50,000 |

| 80CCD(2) employer’s NPS contribution | 50,000 | 50,000 |

| 80D medical insurance | N/A | 50,000 |

| Less : Standard deduction | 50000 | 50000 |

| Professional Tax | N/A | 2,400 |

| Net taxable income | 10,20,000 | 3,97,600 |

| Income tax | 63,000 | 7,880 |

| Rebate u/s 87A | 0 | 7,880 |

| Net tax payable after surcharges | 65,520 | 0 |

By choosing the right tax regime, Mr.Aditya can save Rs. 65,520

Tax Calculator: The Tax Calculator images you see above are given as a bonus to our Tax Masterclass Attendees, if you are interested you can check out India’s craziest and most Practical Tax Masterclass from the link below.

Tax Strategy Masterclass: Link

Budget 2024: Yes the budget 2024 hit us and we are working on updating our Calculator as per the new rules! If you have got the Masterclass already, you will get the updated Calculator soon to your mailbox directly!

4) Report all your income

- Income should be reported from various sources like rental income you pay via cash, or interest from saving accounts, etc.

- We have to make sure these incomes are reflected in our ITR filing so we have to pre check it from sources.

- Not doing so can lead to notices from the IT department.

5) Don’t Miss the Due Date

- Mr.Aditya should file his returns before the deadline of 31st July, if not he should pay Rs.5000 as late filing fees.

- Also 1% interest on the outstanding tax amount for each month of delay.

- For example, filing a month late will cost him Rs. 5560 extra (Rs. 5000 late fee + Rs. 560 interest on Rs. 56,020).

6) Don’t’ forget to cross-check your From 16, AIS and Form 26AS

Mr. Aditya can find the mismatch between the pre-filled data in the ITR forms and the AIS which can occur due to differences in the information reported by various sources.

Following things he can to do to resolve such Mismatch:

- He can review the data by comparing pre-filled ITR forms with AIS to identify differences.

- Verify the sources of the differences from banks, employers, or other entities.

- Gather supporting documents such as bank statements, Form 16, and interest certificates.

- Correct the pre-filled data manually in the ITR form if errors are found.

- Report differences in the AIS to the Income Tax Department via the e-filing portal.

Mismatches between Form 16, AIS, and Form 26AS can trigger income tax notices.

7) Don’t forget to do verification after filing the returns

Mr.Aditya has to verify his ITR after filing, either online or offline.

- Online (e-Verification):

- Log in to your Income Tax e-filing account

- Go to ‘e-file’ > ‘Income Tax Returns’ > ‘e-Verify Return,’

- Verify using Aadhaar OTP, Net banking, etc.

- Offline:

- Print and mail the ITR-Verification form to the Income Tax Department.

- If you do not verify your ITR within 30 days of filing it, the return will be considered invalid.

- Once your return becomes invalid you should file it again with the late filing fees and interest penalty.

FAQs

Can I switch tax regimes if I have a business or professional income?

No, individuals with business or professional income can only switch their tax regime once. This limitation makes it crucial to analyse long-term benefits before choosing a tax regime.

How can salaried individuals determine the best tax regime for them each year?

Salaried individuals have the flexibility to switch between the old and new tax regimes annually. Using a tax calculator, like the one available in our masterclass, can help assess which regime provides the best tax savings based on your income and deductions.

How can I ensure I’ve reported all my income sources accurately?

Cross-checking income from various sources (like rental income, interest, or savings accounts) and comparing it with AIS or Form 26AS can prevent discrepancies that could lead to tax notices.

What are the late filing penalties, and how can they affect my tax payments?

Missing the filing deadline incurs a Rs. 5,000 penalty and 1% interest on unpaid taxes each month, making timely filing crucial to avoid unnecessary costs.

Why do I need to check Form 16, AIS, and Form 26AS for mismatches?

Mismatches between these forms can arise from varying information reported by different sources. Addressing these discrepancies before filing helps prevent notices or discrepancies in tax records.