| The Nifty 50 index has reached a record high of Rs. 25,000, with many small-cap and mid-cap stocks also touching their peak levels. For retail investors, this is both exciting and daunting, as market highs can create a fear of missing out (FOMO), while also raising concerns about potential corrections. |

Let’s look at Mr. Sridhar’s case, to understand how one can navigate such market scenarios.

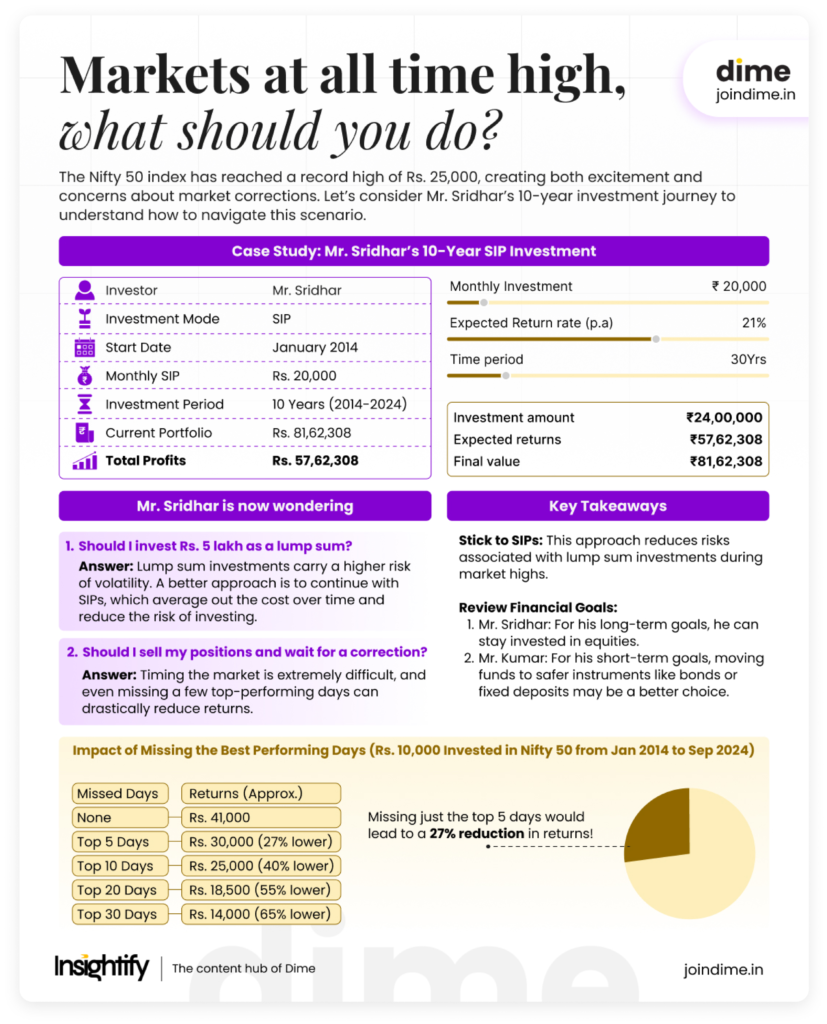

Case Study: Mr. Sridhar’s 10-Year Investment Journey

Mr. Sridhar is extremely happy with his returns, but as the market reaches new highs, he is faced with two choices:

- Should I invest Rs. 5 lakh as a lump sum now to benefit from rising markets?

- Should I sell my positions and wait for a market correction to reinvest?

Answering Mr. Sridhar’s Questions

1. Should I invest Rs. 5 lakh as a lump sum immediately?

It’s tempting to invest a large amount when markets are rallying, but this exposes you to short-term volatility. If the market corrects right after your investment, your lump sum could lose value quickly.

Better approach – Continue SIPs:

SIPs help average the cost over time and reduce the risk of investing at market highs. Mr. Sridhar has seen success with SIPs over the last 10 years, so continuing this strategy allows him to avoid the need to time the market while still benefiting from long-term growth.

2. Should I sell my positions and wait for the market to correct?

Timing the market is very difficult, even for experts.

Trying to sell at the market’s peak and buy back during a dip is known as timing the market, and it’s extremely hard to get right. Even missing a few of the best-performing days can drastically reduce your returns.

Why staying invested is often better

If you had invested Rs. 10,000 in Nifty 50 in January 2014, it would have grown to approximately Rs. 41,000 by September 2024. However, if you missed the top 5 performing days, the same investment would only be worth Rs. 30,000 – a loss of about 27% of potential returns!

So, between Jan 2014 to Sep 2024, the top 5 performing days were

| Date | Daily Returns |

| 07-Apr-2020 | 8.76% |

| 25-Mar-2020 | 6.62% |

| 20-Mar-2020 | 5.83% |

| 20-Sep-2019 | 5.32% |

| 1-Feb-2021 | 4.74% |

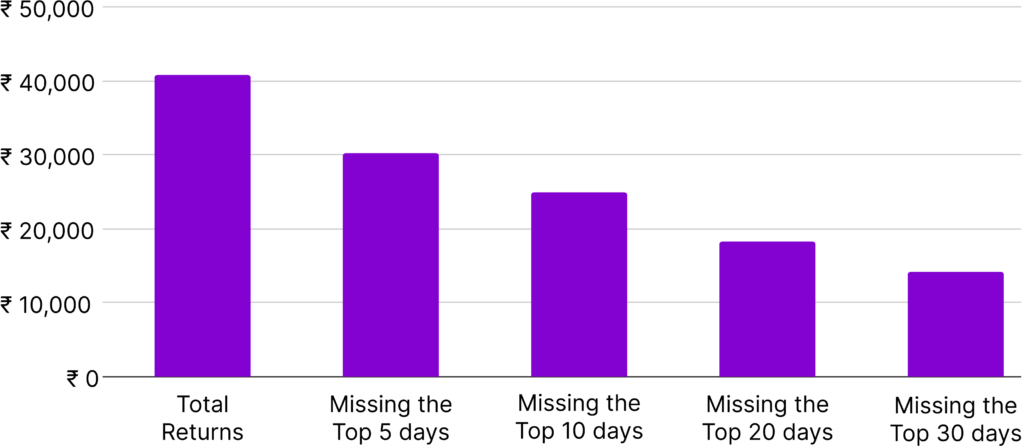

Impact of Missing Top 5, 10, 20, and 30 Days

| Missed Days | Returns |

| None | Rs. 41,000 |

| Top 5 Days | Rs. 30,000 |

| Top 10 Days | Rs. 25,000 |

| Top 20 Days | Rs. 18,500 |

| Top 30 Days | Rs. 14,000 |

The current value of the Rs.10,000 invested in Nifty 50 during January 2014 is around Rs.41,000, as of September 2024 but if one has missed the top performing 5 days of Nifty50 shown above then the current value will be only around Rs.30,000 which is around ~27% fall in returns.

Similarly if one misses the top 10, 20 and 30 days, the fall in returns would have been -40%, -55% and -65% respectively.

This demonstrates the difficulty of predicting market movements, making staying invested a smarter option for long-term success.

What Should Investors Keep in Mind?

1. Stick with Systematic Investment Plans (SIPs)

SIPs allow investors like Mr. Sridhar to stay disciplined during market ups and downs. They benefit from cost averaging, meaning Mr. Sridhar buys more units when prices are low and fewer units when prices are high, which reduces risk over time.

This is called time diversification – spreading your investments across multiple periods to smooth out the price fluctuations.

2. Review Your Financial Goals

Before making decisions during market highs, it’s essential to align your investments with your financial goals and risk tolerance.

Example 1:Mr. Sridhar (Long-Term Goals)

At age 35, Mr. Sridhar doesn’t have any urgent financial goals, so he can afford to remain invested in equities even when the market is at its peak. His long-term goal allows him to withstand any short-term volatility.

Example 2: Mr. Kumar (Short-Term Goals)

Mr. Kumar, who has been investing for his daughter’s wedding next year, may want to liquidate part of his equity investments at the market peak. Since he needs the funds soon, he can transfer them to safer, fixed-income options like bonds or fixed deposits, which protect his capital from market volatility.

Conclusion

Markets naturally move in cycles. While it’s tempting to make impulsive decisions during a bull run or a correction, sticking to a well-thought-out plan and avoiding emotional decisions can help you stay on track to achieve your financial goals.

SUMMARY

Refer the image below for the summary of the entire Read. Hope you became smarter with money now.

FAQs

Why is timing the market considered risky?

Market timing is challenging, even for experts. Missing just a few of the best-performing days can significantly reduce your returns, as seen in the case of Nifty 50 returns over the past decade.

What is cost averaging, and how does it work in SIPs?

Cost averaging occurs when you buy more units during market lows and fewer units during highs. This strategy reduces the overall cost per unit and mitigates investment risk over time.

How do SIPs help during market corrections?

SIPs allow you to buy more units when markets drop, lowering your average cost per unit. This ensures you remain disciplined and avoid emotional decisions during corrections.

Is it better to rebalance my portfolio at market highs?

Rebalancing can be a good strategy. You may lock in profits from equities and reinvest in safer asset classes based on your financial goals and risk tolerance.

What’s the risk of selling positions and waiting for a correction?

Selling at a peak and waiting for a correction can lead to missed opportunities if the market continues to rise. Predicting corrections accurately is extremely difficult.

Should I stop SIPs if the market is at a record high?

No, stopping SIPs at market highs may hinder your long-term strategy. SIPs naturally adjust for volatility, buying fewer units at highs and more at lows.