Healthcare costs are the money you spend on anything related to your health. This includes doctor visits, diagnostic tests, hospital stays, and even the medicines you pick up from the pharmacy.

With medical inflation in India reaching 14%, healthcare costs are rising faster than ever, putting a significant strain on household budgets.

But how does this actually affect you?

Let’s take a look at the monthly healthcare costs for the five most common chronic diseases in India:

Disclaimer: These are approximate values based on real data; however, the prices may vary depending on several factors, such as the severity of the condition or the location of treatment.

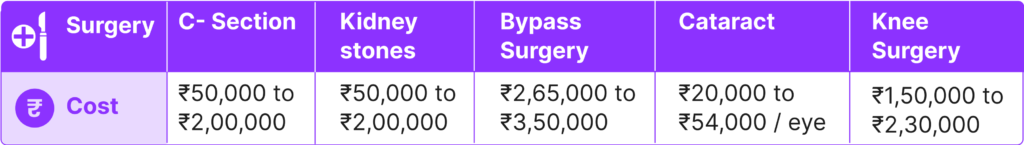

Sounds much? Here’s the cost of the 5 most common surgeries in India:

As you can see, the costs can add up quickly, especially if you’re dealing with multiple conditions.

Because of these rising healthcare costs, a large portion of India’s population is struggling to manage their medical expenses.

As a matter of fact-

According to a Niti Aayog report, 7% of India’s population or approximately 10 crore people fall into poverty yearly due to healthcare costs. In fact, 1 in 4 urban Indian households that have taken out loans did so to cover medical expenses.

What Can You Do About These High Costs?

Start Planning Today! The rising costs of healthcare can catch anyone off guard, but there are steps you can take to protect yourself from the financial strain.

1. Health Insurance

With countless health insurance options available, it’s wise to consult an advisor to find the best plan for you and your family, however,

Here are 5 Things to Consider Before Buying Health Insurance:

| Check for ‘Co-Pay’ Clause | Review Pre-Existing Condition Coverage |

| Ensure your policy doesn’t include a co-pay clause, where you’re responsible for a percentage of the medical bill. | Make sure your policy covers any existing health conditions or find out about the waiting period. |

| Know the ‘Waiting Period’ | Check for ‘Co-Pay’ Clause |

| Be aware of the initial waiting period (30-90 days) during which no claims are payable, except for accidents. | Ensure your policy doesn’t include a co-pay clause, where you’re responsible for a percentage of the medical bill. |

| Understand Policy Exclusions |

| Get a clear list of what’s not covered, like dental care or pregnancy, to avoid surprises later. |

2. Emergency Funds / Savings

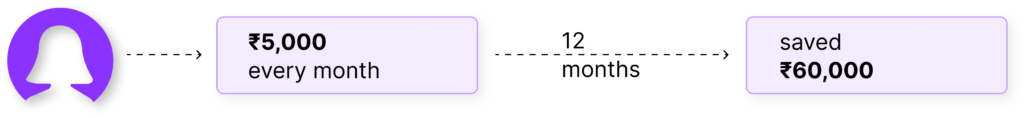

You can save a little each month to build a health emergency fund, which can help cover unexpected medical expenses. Better yet, by investing that money in a flexible and secure mutual fund, your savings could grow, providing a larger cushion for emergencies.

Meera decides to save ₹5,000 every month for unexpected medical expenses. By the end of 12 months, she would have saved ₹60,000.

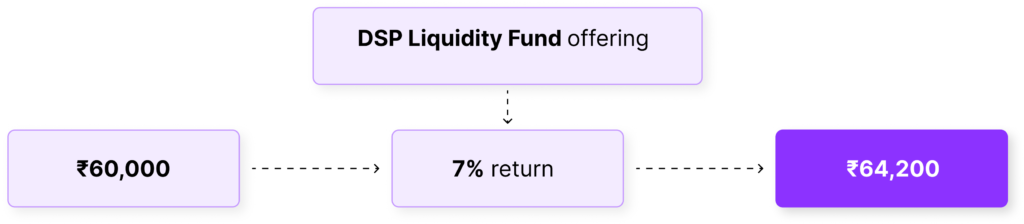

However, with a liquid and accessible mutual fund, such as

This way, her emergency fund can grow and still be easily accessible in case of emergencies.

3. Public Healthcare Facilities

You can save money by opting for public healthcare facilities for routine check-ups and minor treatments, which provide these services at a fraction of the cost of private hospitals.

Pro Tip: You can reduce your medication costs significantly by purchasing from a Jan-Aushadhi Kendra. (Government outlets providing generic medicines at affordable prices)

In a nutshell, rising healthcare costs can significantly impact your finances. But with financial planning and, of course, a focus on preventive care, you can safeguard your financial health against unexpected medical expenses.

SUMMARY

Refer the image below for the summary of the entire Read. Hope you enjoyed the Read!