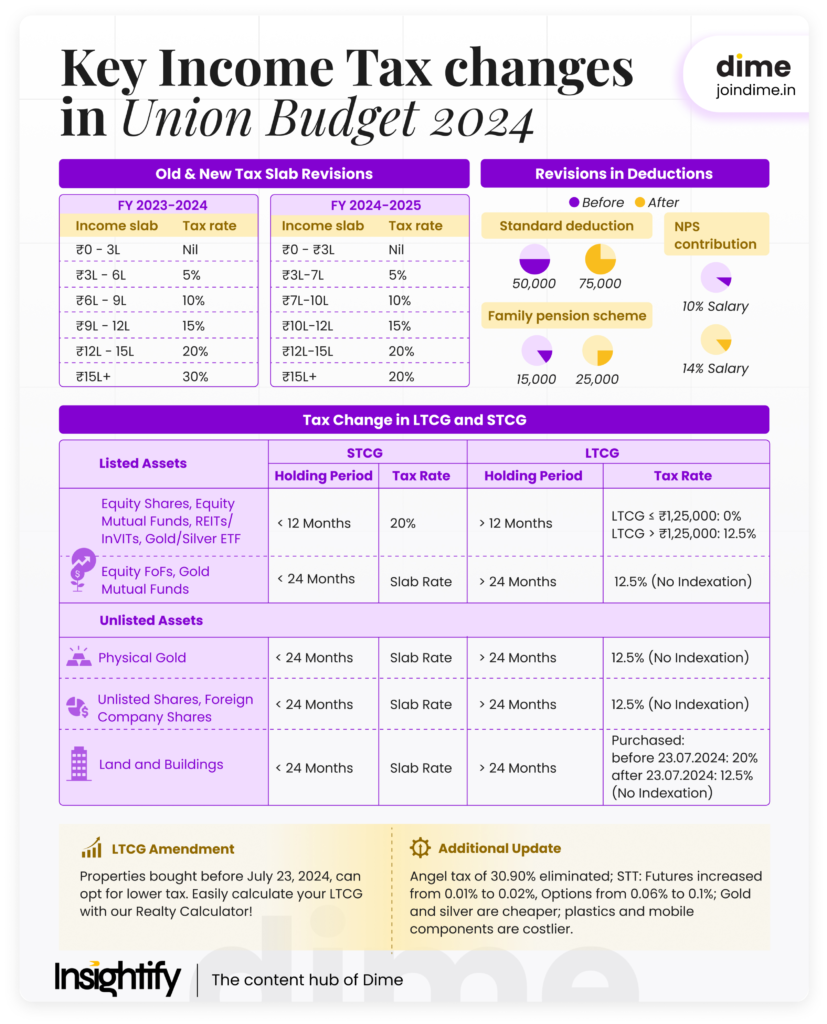

Union Budget updates often bring key changes that can impact your finances throughout the year. This year’s budget introduces new tax slabs and additional deductions, including an opportunity for taxpayers to save up to ₹17,500. Understanding these changes will empower you to make informed decisions about your savings and investments.

Example

Meet Ramesh, a 35-year-old marketing professional based in Mumbai. With a gross annual salary of ₹16 lakhs, he’s eager to understand how the recent changes in tax laws and deductions will affect his tax calculations for the upcoming financial year.

| Details | Before the changes | After the changes |

| Gross Salary | ₹16,00,000 | ₹16,00,000 |

| Deductions | ||

| Standard Deduction | ₹50,000 | ₹75,000 |

| Family Pension Deduction | ₹15,000 | ₹25,000 |

| NPS Contribution | ₹1,60,000 (10% of salary) | ₹2,24,000 (14% of salary) |

| Total Deductions | ₹2,25,000 | ₹3,24,000 |

| Taxable Income | 16,00,000 -2,25,000 =₹13,75,000 | 16,00,000-3,24,000 =₹12,76,000 |

These revised figures should accurately reflect the impact of the NPS contribution and other deductions based on a gross salary of ₹16,00,000.

Old Tax Slab

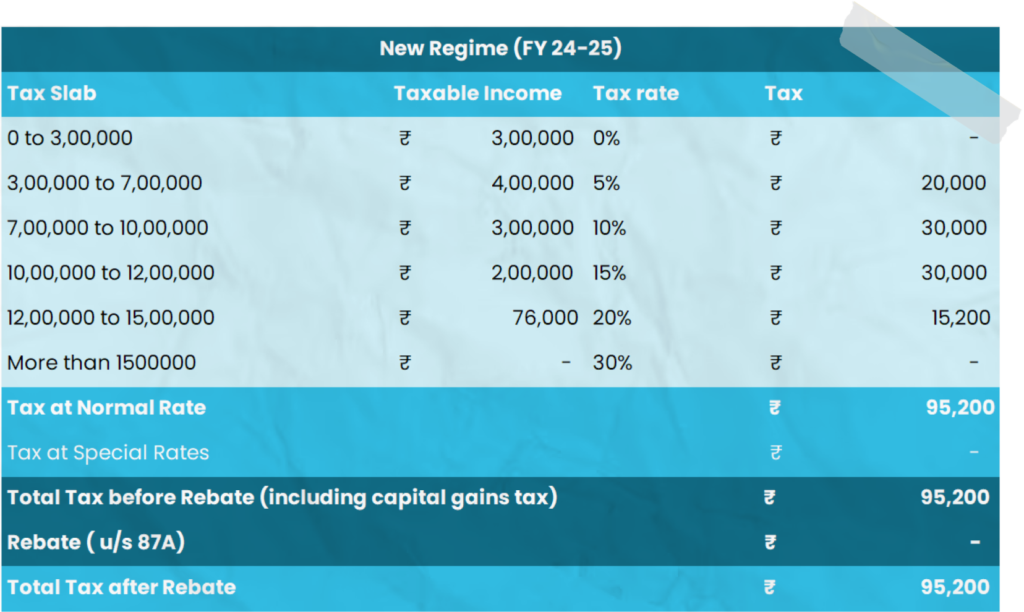

New Tax Slab

Source: Dime Tax Calculator

With the revised tax regime, Ramesh’s total tax liability is calculated to be ₹95,200. This outcome reflects the updated tax structure and deductions, demonstrating that the new tax slab rates are simpler and result in a lower tax burden compared to the old regime.

The above table screenshots are from our Dime Advanced Tax Calculator which is a part of our Tax Strategy Masterclass which is popular for it’s case study approach. If interested, click the link

Understanding the changes in LTCG and STCG

Long-Term Capital Gains (LTCG): Profits from selling assets such as listed and unlisted financial securities (e.g., stocks, mutual funds) or non-financial assets (e.g., real estate, gold) held for over a year/two year/three year based on the asset class have been changed.

Short-Term Capital Gains (STCG): Profits from selling assets, including listed and unlisted financial securities or non-financial assets, within a year are taxed at a higher rate.

Ramesh wants to see how the new tax rules affect his long-term and short-term capital gains.

Listed assets

| Asset Class | LTCG | STCG | |||

| Holding Period | Tax Rate | Holding Period | Tax Rate | ||

| Equity shares | < 12 months | 20% | > 12 Months | 12.50% without indexation after an exemption of 1.25 lakhs | |

| Equity mutual funds | > 12 Months | 20% | > 12 Months | 12.50% | |

| Debt Mutual funds (debt instruments constitute >65% of holding) | Purchased before 1st April, 2023 | < 2 years | Slab Rate | 12.5% without indexation | |

| Purchased on or after 1st April, 2023 | No holding period | As per Income tax slab | No holding period | As per Income tax slab | |

| Hybrid Mutual funds(35% equity)/ Market Linked Debentures | Purchased before 1st April, 2023 | < 2 year | As per Income tax slab | < 2 year | 12.5% without indexation |

| Purchased on or after 1st April, 2023 | No holding period | As per Income tax slab | No holding period | As per Income tax slab | |

| Hybrid Mutual fund(35%-65% equity) | < 12 Months | 20% | > 12 Months | 12.5% without Indexation | |

| Listed Bonds | < 12 Months | 20% | > 12 Months | 12.50% | |

| 12 Months | |||||

| REITS/InVITS | < 12 Months | 20% | > 12 Months | 12.50% without Indexation | |

| Equity FoFs | < 24 Months | Slab Rate | >24 Months | 12.50% without Indexation | |

| Gold/Silver ETF | < 12 Months | Slab Rate | >12 Months | 12.50% without Indexation | |

| Overseas FoF’s | < 24 Months | Slab Rate | >24 Months | 12.50% | |

| Gold Mutual Funds | < 24 Months | Slab Rate | >24 Months | 12.50% without Indexation | |

Unlisted Assets

| Asset Class | STCG | LTCG | |||

| Holding Period | Taxation | Holding Period | Taxation | ||

| Unlisted Bonds | < 24 Months | Slab Rate | >24 Months | Slab Rate | |

| Physical gold | < 24 Months | Slab Rate | >24 Months | 12.5% without Indexation | |

| Unlisted shares | < 24 Months | Slab Rate | >24 Months | 12.5% without Indexation | |

| Foreign company shares | < 24 Months | Slab Rate | >24 Months | 12.5% without Indexation | |

| Land and Buildings | Property Purchased before July 23, 2024 | < 24 Months | Slab Rate | >24 Months | 20% with Indexation |

| Property Purchased after July 23, 2024 | < 24 Months | >24 Months | 12.5% without Indexation | ||

Latest Amendment on LTCG for Properties:

Taxpayers with properties purchased before July 23, 2024, have the choice to select the option that results in a lower tax liability. For properties acquired on or after this date, the new rules will apply without any choice. To calculate your Long-Term Capital Gains (LTCG) under the old or new rules, use our Realty Calculator [click here]

Angel Tax Policy

The angel tax, previously levied at a rate of 30.90%, has now been abolished following the changes in the budget.

Changes in Securities Transaction Tax (STT) Rates

Securities Transaction Tax (STT) is a direct tax applied to the purchase and sale of securities like stocks, mutual funds, and derivatives on Indian stock exchanges.

| Type | Old STT rate | New STT rate |

| Futures | 0.01% | 0.02% |

| Options | 0.06% | 0.1% |

Impact of recent market changes: Cheaper vs costlier Items

Ramesh should consider how recent market changes and new tax rules affect various sectors. This understanding will help him make better investment and spending decisions.

For example, the recent tax changes have impacted various sectors differently.

| Cheaper Items | Costlier Items |

| Gold,Silver, platinum | Non-biodegradable plastics, plastic products |

| Capital goods in manufacturing of solar cells and modules | Renewable sector |

| 3 cancer drugs | PCBA of specific telecom sector |

| 25 Critical minerals | Ammonium nitrate |

| Mobile phones/ charges/ PCBA | |

| Leather goods and seafood | |

| Ferro nickel and blister copper |

This year’s budget brings notable tax changes, impacting deductions, investments, and spending, guiding taxpayers like Ramesh to adjust their financial strategies accordingly.

Summary

Refer the image below for the summary of the entire Read. Hope you became smarter with money now.

FAQs

How does the new LTCG tax structure impact property sales?

Properties purchased after July 23, 2024, face a flat 12.5% LTCG tax without indexation. Sellers of older properties can choose between the 20% indexed or the 12.5% flat rate.

How are debt mutual funds taxed under the new rules?

Gains from debt mutual funds purchased on or after April 1, 2023, are taxed as per your income slab, removing earlier benefits of LTCG taxation after 3 years.

How does the abolition of the angel tax benefit startups?

The angel tax removal eliminates the 30.9% tax on capital raised from investors, encouraging investment in startups and improving their growth potential.

Why has the tax benefit for overseas funds been restricted?

Gains from overseas funds now fall under slab rates, eliminating earlier LTCG benefits. This discourages foreign investments and encourages local fund alternatives.

How does the increased standard deduction affect my taxable income?

The standard deduction under the new tax regime is increased from ₹50,000 to ₹75,000, reducing taxable income by ₹25,000 for salaried individuals and pensioners. This benefit is not available under the old regime.