Understanding Form 16, AIS, and Form 26AS

To understand the compilation of AIS data, it’s crucial to first grasp the roles of Form 16 and Form 26AS.

What is Form 16?

Form 16 is issued by your employer annually and provides details of the salary earned by you and the amount of TDS (Tax Deducted at Source) cut from your salary. It contains comprehensive information on earnings, deductions, and the net tax paid to the government.

Form 16 has two parts:

- Part A: Contains basic details, such as:

- Name, PAN, TAN, and Address of the employer and the employee

- Assessment year

- Summary of payment

- Summary of TDS by your employer

- Part B: Contains a detailed breakup of your salary, allowances, and deductions.

What are Form 26AS and the AIS?

Form 26AS: Form 26AS is a statement that shows all the tax-related information associated with the assessee’s PAN.

It includes the following:

- Details of tax deducted at source (TDS)

- Tax collected at source (TCS)

- Advance tax paid by the assessee

- Self-assessment tax paid

- Refunds issued to the taxpayer

- Details of high-value transactions such as foreign remittances, mutual fund purchases, dividends, etc.

Annual Information Statement (AIS): The Annual Information Statement (AIS) is a comprehensive financial statement providing a detailed summary of a taxpayer’s financial transactions. It includes information about income, investments, and expenses reported to the tax authorities. AIS is an extension of Form 26AS and includes additional details.

AIS has two parts:

Part A: Contains general information such as PAN, Aadhaar Number, name of the taxpayer, date of birth, mobile number, email address, and address of the taxpayer.

Part B: Contains details of:

- TDS/TCS (Tax Collected at Source) Information

- SFT (Statement of Financial Transaction) Information, including dividends, interest from savings bank accounts, securities/mutual fund transactions, etc.

- Payment of Taxes (Advance Tax and Self-Assessment Tax)

- Demand raised and Refund initiated

- Other Information (Interest on refund, Outward Foreign Remittance/Purchase of Foreign Currency, etc.)

- AIS includes all the information in Form 26AS, plus additional details like savings account interest, dividends, rent received, purchase and sale transactions of securities/immovable properties, foreign remittances, interest on deposits, GST turnover, etc.

- Form 26AS displays details of property purchases, high-value transactions, and TDS/TCS transactions carried out during the financial year.

- AIS includes all the information in Form 26AS, plus additional details like savings account interest, dividends, rent received, purchase and sale transactions of securities/immovable properties, foreign remittances, interest on deposits, GST turnover, etc.

- Form 26AS displays details of property purchases, high-value transactions, and TDS/TCS transactions carried out during the financial year.

Scenario:

Mr. Anish, Product Manager at Ace Software Solutions is preparing his tax return and notices a mismatch between the pre-filled information and Annual Information Statement (AIS).

Pre-filled Data in ITR Form:

Dividends: ₹12,000

Interest Income: ₹6,000

AIS Reported Data:

Dividends: ₹10,000

Interest Income: ₹5,000

The difference in reported figures can have 2 cases

Case 1: There could be the right value in the AIS and the mismatch could be in the Pre-filled information ITR portal . In that case, he will have to change the wrong value to the right value in his Pre-filled information ITR portal so it matches the value of AIS.

Case 2: The values in AIS and Pre-filled information ITR portal are both incorrect. Thus, he will have to correct the value first in AIS so it gets corrected in the Pre-filled information ITR portal.

Reasons:

- Incorrect Pre-filled Data: The pre-filled data in Mr. Anish’s ITR form might contain errors, leading to discrepancies with the AIS.

- Delayed Reporting: The dividend and interest income reported in the AIS might not yet reflect recent updates or income, causing a mismatch.

- Incorrect Reporting: Financial institutions may have reported incorrect figures for dividends and interest income in the AIS.

- Reporting Changes: Updates or changes in reporting formats by financial institutions may not have synced with the AIS yet.

- Multiple Income Sources: Income from different accounts may be reported separately, resulting in differences between the Pre-filled form and the AIS.

Correction of Mismatch :

Once Mr. Anish notices the mismatch between the pre-filled information in his ITR form and the data in the Annual Information Statement (AIS), He should take the following steps to update his AIS:

Step 1 :

Log in to your e-filing account on the Income Tax Portal using your PAN and password.

Step 2 :

After logging in, click on the AIS option on the blue-coloured bar

Step 3 :

Now on the AIS Instructions page, click the AIS button at the top.

On the next page, choose between TIS (Taxpayer Information Summary) and AIS. Click AIS.

Step 4 :

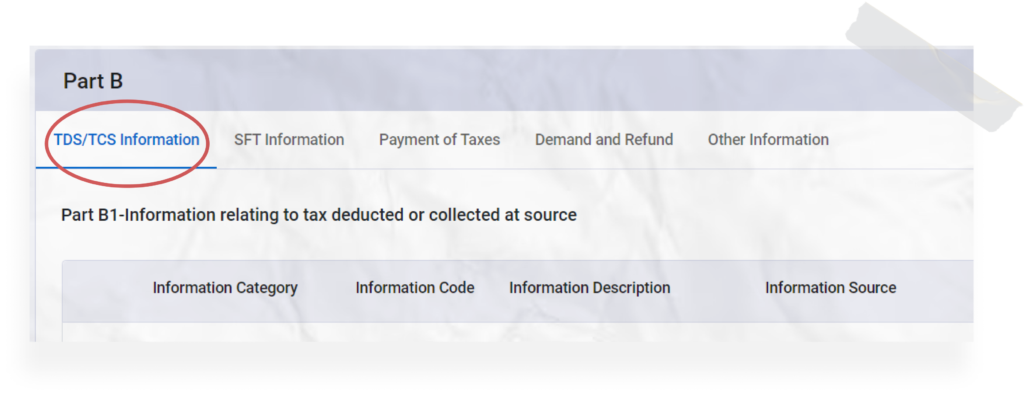

On the next page, your information is categorised under Part A and Part B. Part B contains all your TDS/TCS, SFT, Demand & Refund, and other details where the feedback is to be updated.

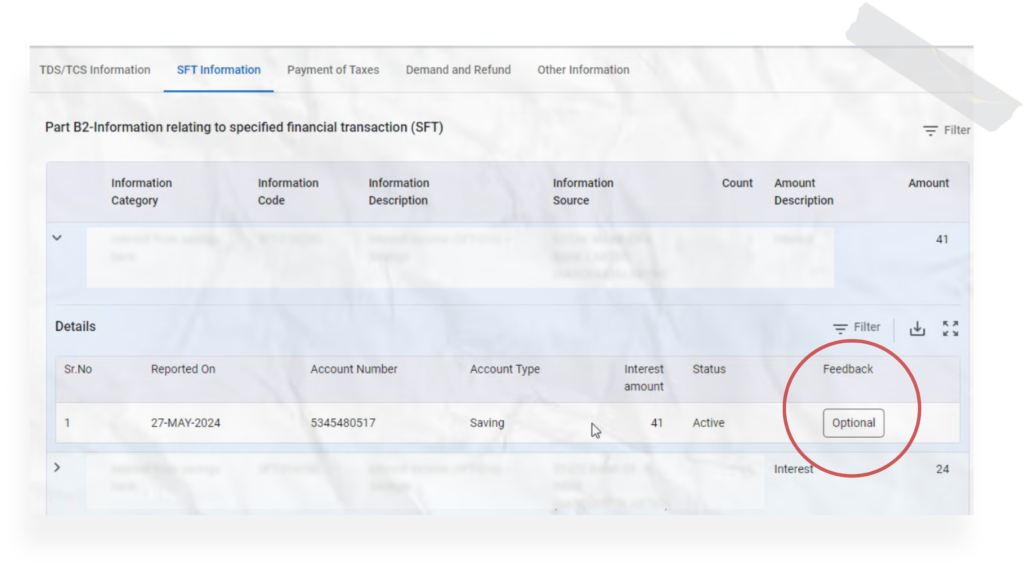

Step 5 :

1. Click on the mismatched information

And click the “Optional” button in the Feedback column to access the Add Feedback screen.

Step 6 :

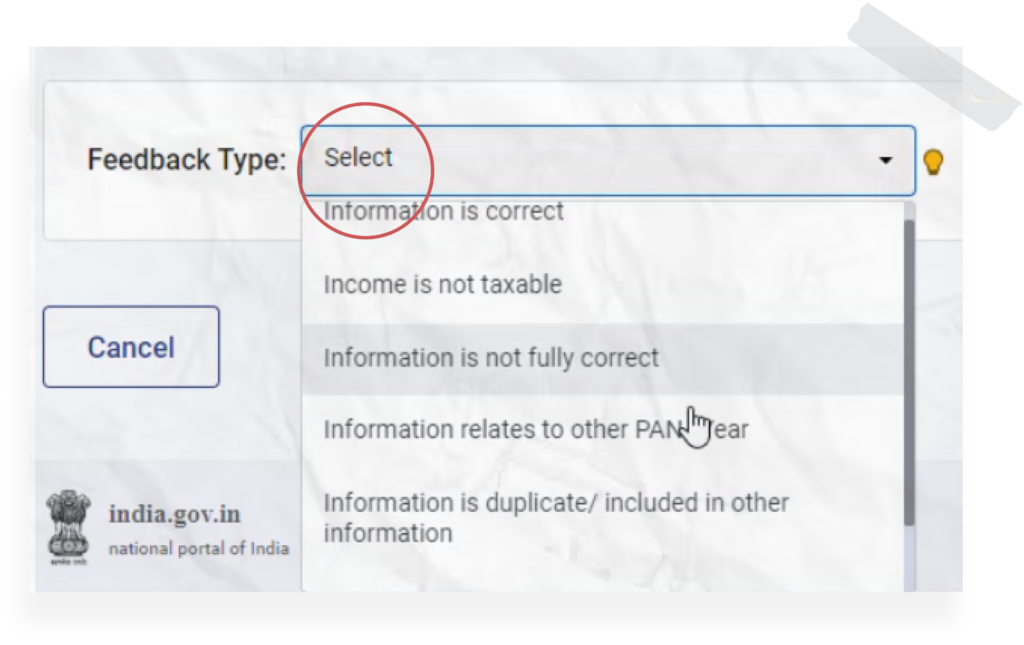

You will see a dropdown named Feedback Type, where you can see the following six options.

- Information is correct

- Income is not taxable

- Information is not fully correct

- Information relates to other PAN/Year

- Information is duplicate/included in other information

- Information is denied

Step 7 :

Once you choose your feedback, additional information could be asked depending on your feedback.

Once you submit your feedback, the Activity History tab will be updated, and you will be able to download Acknowledgement Receipt.

Email and SMS confirmations for submission of feedback will also be sent.

FAQs

What should I do if my pre-filled ITR data doesn’t match the AIS?

If you notice a mismatch, verify the accuracy of both your ITR form and AIS information. You may need to update incorrect data in the pre-filled ITR form or submit feedback to correct AIS details.

What feedback option should I choose if the AIS information is inaccurate?

The feedback options are based on the nature of the discrepancy. For instance, select “Information is not fully correct” if there’s an error in the reported income amount, or “Information is duplicate/included in other information” if it’s repeated.

Why does AIS data sometimes show lower income than my actual income?

Delays in reporting by financial institutions or updates to transaction records can cause discrepancies. Always verify these figures with your actual income records and correct them in the AIS if needed.

Can AIS mismatches lead to a tax notice?

Yes, mismatches between AIS and your filed ITR can result in tax notices. Accurate reporting and addressing discrepancies beforehand can help avoid such issues.

Is AIS different from Form 26AS, and why is it important for ITR filing?

Yes, AIS includes more comprehensive financial data than Form 26AS, such as savings interest, securities transactions, and high-value purchases. Reviewing AIS can help ensure your ITR reflects all taxable income.