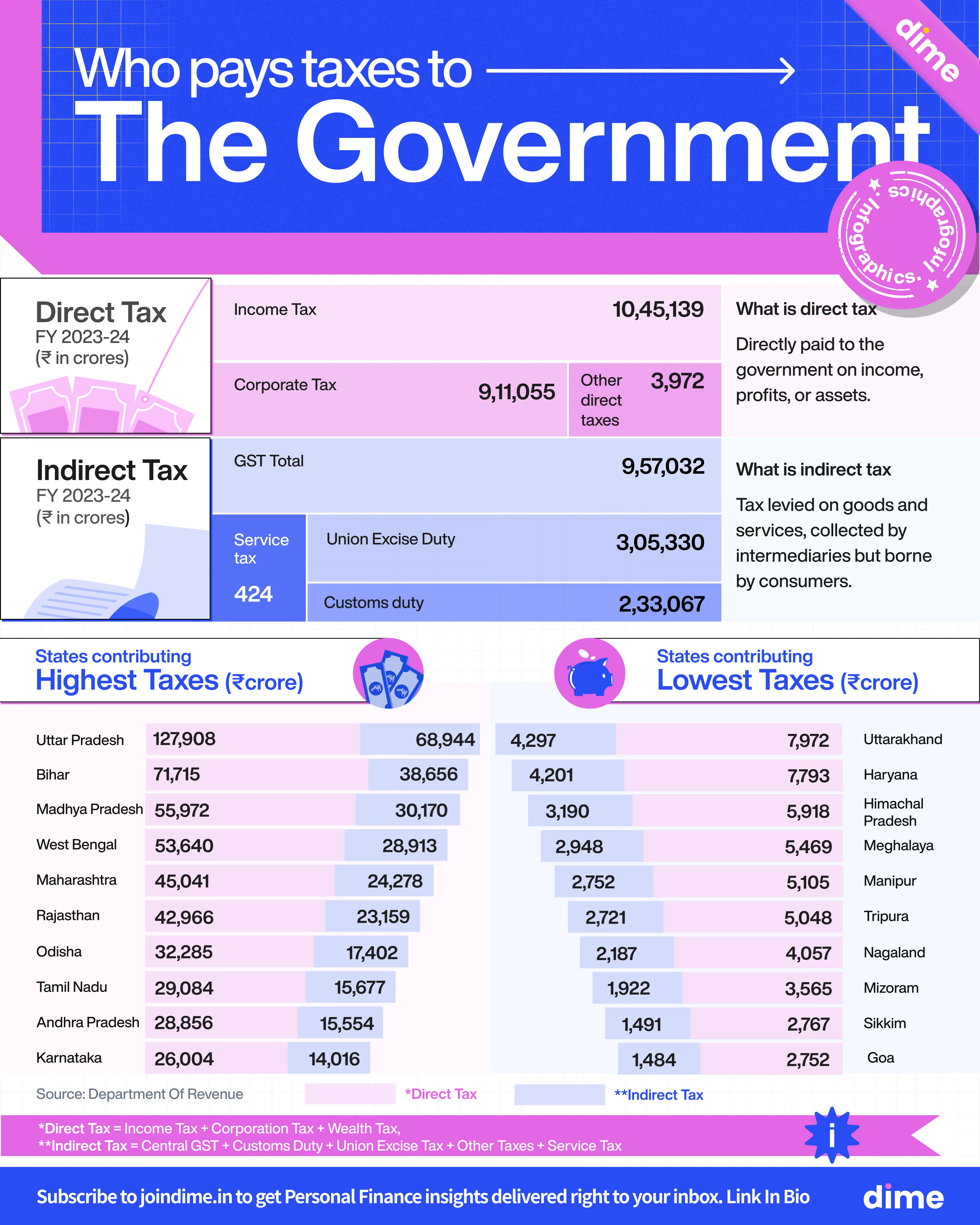

Breaking down India’s tax collections

Imagine thirty years ago,

Health insurance is a financial safety net that covers medical expenses like hospitalisation, treatments, and medications, protecting your savings and ensuring access to quality healthcare when needed

But, is it that simple?

While Health Insurance industry in India processes more than 90% of claims successfully, policyholders may still experience other issues, such as.

These issues often arise from policyholders not understanding the policy terms, processing delays, incomplete documentation, or communication gap between insurers and policyholders.

- Deductions in claim amounts,

- Deductions in claim amounts,

- Deductions in claim amounts,

Conclusion

To find the right health insurance, start by comparing policies online and thoroughly reading the fine print to understand these limits and benefits.

Look for policies that align with your health needs, and don’t hesitate to ask insurers for customisations like higher room rent limits or daycare coverage.

If you’re still unsure, consult a trusted insurance advisor and don’t buy a policy until you’re sure because you don’t go buying health insurance everyday or even every year!

.webp)

.webp)